This article will discuss the Google Apps for Learning Financial Literacy. In the current global economic situation, pre- or post-COVID, the world has been passing through a period of uncertainty. Again, if you look back into the recent economic history of the world, people have never experienced such phenomenal growth in consumerism. Consumerism undoubtedly increased demand for goods and services to make people’s lives easier, but it also had a negative side due to such irrational spending. Further, to add to the woes, people fell in love with easy finance and the financial system’s tools to take consumerism to peak levels. In short, people never actually saved, but their instruments allowed them to spend beyond their means, which later got out of control.

Table of Contents

It is now apparent that there is a lack of financial literacy in most of the population. It is also why people’s spending always overtook their earnings by a spectacular margin. Financial literacy is not just about spending within the limits of earning but building healthy money habits for budgeting, debt, savings, investing, and so on. The rampant use of numerous credit cards is avoided, and people do not struggle through life endlessly.

Unfortunately, schools do not teach students about financial literacy since there are no teachers or a topic on the curriculum. As a result, it has never been higher than the other regular subjects when it comes to importance. Therefore, good financial literacy can stop excess credit card use, domestic violence, economic crimes, divorces, suicides, and insecurity in families.

However, you can learn financial literacy easily by downloading the best Google apps for learning financial literacy. The below-given three best apps can help anyone learn about financial literacy, irrespective of their age.

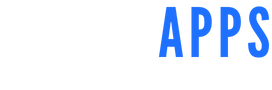

1. The World of Money App

The World of Money app is a video presentation that answers all your basic questions about financial independence through proper resource regulation. The app is for young people, from kids to young people of around 25 years. There is nothing wrong if you would like to download the app as it offers the basic steps to financial literacy to watch their extravagance when they attain full adulthood. The fact is that the above age needn’t be a limit, for several adults have no control over their finances. The course includes ways to save money, spend it responsibly, and basic insights into banking, investments, and other related commercial transactions.

The app is free to use, and there are quizzes for those viewers who perhaps feel that they have learned everything, while in reality they don’t get to answer all the queries. The course is again divided according to age groups, and these are: ‘Young Moguls Group’ for children between 7 and 9 years old; ‘Rising Moguls Group’ for children between 10 and 12 years old; ‘Moguls Group’ for students between 13 and 18 years old; and lastly, ‘Super Moguls Group’ for ages 19 to 26 years old.

Teachers of the same age group teach each group, which makes this app resonate perfectly with students and teens. It also means that students of each group are only taught what is relevant about money matters in their present status. In short, kids learn about the basics of wants and needs, while the older children and teens learn higher levels of budgeting and investment ideas, especially in the stock market, credit cards, etc. The highlight of this app is the quiz that comes after each lesson and reigns in the learners’ focus.

You will find it among the best Google apps for learning financial literacy. The app instructs you on unique and simple ways to manage when people face the financial realities of the world. On higher levels, you learn to keep your money mindset alive and think pragmatically about why the poor are getting poorer and the rich are becoming more prosperous. You get good glimpses of taxes, financing your education, and more in this fantastic app.

2. Rooster Money App

The Rooster Money app offers a different approach to making people financially literate. It is an app that focuses on families where the family keeps track of kids spending in real-time and encourages their savings and prudence in money matters with timely rewards and gifts. The whole process gets started with the family helping out the children with the instructions given in the Rooster Money app.

Kids are encouraged to save money as a step-by-step approach and start to save their money in their piggy bank initially. Later on, they will be guided to have a Rooster Card, which acts like a kid’s prepaid debit card or a Visa debit card. Then, with parents’ slight degree of control over their kid’s spending habits, the child learns the basic art of thrift and savings. The family member can also use the number of features on the app about savings, including the Pots System, goal settings and achievements, current balances and statements, etc., as per their preferences.

The app focuses intensely on savings incentives for kids, encouraging them to save more. Hence, the reward chart for the app is not to be taken lightly. You can exercise control by limiting its use in certain shops, making online payments, or withdrawing money from ATMs. You can also get notifications whenever your kids purchase from their Rooster Card and give them a gift or credit some money into their account from your account with the same app. Above all, kids learn about money management, savings, and budgeting through the apps’ excellent instructions.

The app is free, yet you need to subscribe to the Rooster Plus plan.

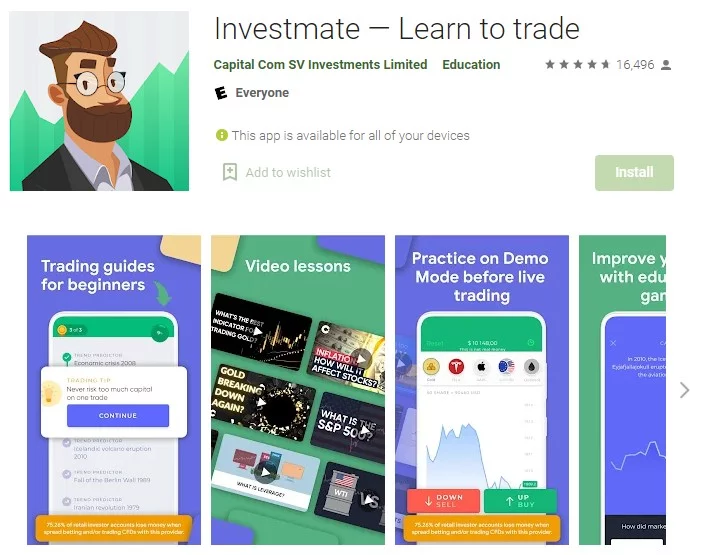

3. Investmate App

The Investmate app is not for kids but for those who are beginning their journey into the world of CFD, or Contract for Difference. The app offers a professional approach throughout its course. It provides a wide range of in-depth details on stock market trading, foreign exchange trading, commodities trading, indices trading, and futures trading. The Investmate app is your best bet, as in the real world, most people currently come across news of stocks and share trading, where lots of money is earned and lost.

It is generally understood that the root cause of losses in the stock market is poor knowledge of trading platforms, recklessness, and gambling instincts. The app allows newcomers to deal with such situations by helping them make informed decisions while trading in shares, commodities, or futures. Any kid who grows up in any profession is likely to get connected with stocks and shares one day or another. Hence, to clarify the otherwise complex CFD trading system, the Investmate app is the best available for you to master the topic of real-time gains.

You can choose your target price and track your progress with the quick lessons provided in the app. For beginners, the Google apps for learning financial literacy have a trading simulator, and you do all the transactions with fake money to become an expert in it. It also offers several options for you to trade with counterfeit money, and you must learn it thoroughly before investing in stocks or commodities.

The lessons are well explained, and it is undoubtedly an app worth downloading on your mobile device.

Also read: The Best Ocarina App for Android.